April 14, 2020

On March 28, 2020, CNN reported that Thomas Keller, the owner of well-known U.S. restaurants such as The French Laundry and Per Se, is seeking a court judgment to confirm that his insurance company should cover his coronavirus-related business losses. Keller’s attorney says the suit is intended to establish legal precedent, so that businesses facing mandated closures are covered by their business interruption policies. On April 3, 2020, Global News reported that a national class action has been commenced against all indemnity insurers in Canada, alleging breach of contract for refusing to pay business interruption insurance because only “physical losses” will be covered.

These suits pose the question that most business owners around the world are asking: is my business covered for coronavirus-related business losses? The answer is in your policy.

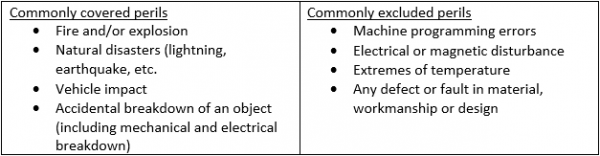

In most cases, there must be physical damage to a business premises caused by a covered peril, or a civil authority closure-order triggered by a covered peril. While most commercial insurance policies and traditional business interruption policies may not offer coverage for disruption due to a pandemic such as COVID-19, a very recent decision of the Ontario Superior Court of Justice, MDS Inc. v Factory Mutual Insurance Co., 2020 ONSC 1924 (MDS Inc.), may support businesses arguing for an expanded definition of “physical damage” to obtain coverage for business interruption losses in the context of COVID-19.

Business Interruption Insurance

Insurance is available for any loss the industry may identify, quantify and price. Most businesses take out coverage for natural disasters. Business interruption insurance covers lost income when your business cannot operate because of a disaster. While specialty coverage is available for disruption due to a pandemic, it is not common in Canada and most businesses do not subscribe for it, probably because of the increased cost and what was likely considered, before now, to be a remote possibility of occurrence. A typical business interruption clause found in Canadian commercial insurance policies states that:

This policy is extended to cover loss directly resulting from the necessary interruption of business incurred by the Insured during the Period of Interruption. This loss must directly result from the direct physical loss or damage insured against by this policy. In addition, the loss or damage must be to property not otherwise excluded by this policy, utilized by the Insured and located at Premises described in the Declarations.

Another common form of insurance is contingent business interruption, which covers losses due to supply chain disruptions caused by insured perils. Coverage is also often extended when access to/from a business premises is specifically prohibited by an order issued by a civil or military authority as a direct result of an insured peril. For example, much of downtown Calgary was ordered to be shut down immediately following the 2013 floods. While many downtown offices did not flood, businesses operating from those offices were required to close and successfully claimed for business interruption losses as a result.

Interpretation of Insurance Contracts

Whether a business is covered for interruption loss depends on the proper interpretation of the clause in each individual policy. An insurance policy is a contract and is generally to be interpreted like any other contract. The wording of the contract must be given its plain and ordinary meaning. The contract sets out which risks are covered, and the insurer is paid for covering those specific risks. Coverage clauses should be interpreted broadly, and exclusion clauses should be read narrowly.[1]

If the language of the policy is unambiguous, a court should give effect to its clear language, reading the contract as a whole. Where the policy’s language is ambiguous, general rules of contract construction must be employed to resolve that ambiguity. For example, the interpretation should be consistent with the reasonable expectations of the parties, should not give rise to unrealistic results, and should be consistent with the interpretations of similar insurance policies. If ambiguity remains, the ambiguity may be construed against the insurer, because the policy is the insurer’s creation.

Many policies share a similar alternating structure: they set out the type of coverage, followed by specific exclusions, with some exclusions containing exceptions. The insured has the onus of first establishing that the loss falls within the initial grant of coverage; the onus then shifts to the insurer to prove that an exclusion to coverage applies; finally, if an exclusion applies, the onus shifts back to the insured to prove an exception to the exclusion.[2]

The Insurance Industry Position

If a pandemic is not specifically included as a covered peril, insurers will strongly resist any attempts by insureds to have Courts “read in” such coverage since, they may argue, this would jeopardize coverage for clearly covered losses. As David A. Sampson, president and CEO of The American Property Casualty Insurance Association recently stated: “If policymakers force insurers to pay for losses that are not covered under existing insurance policies, the stability of the sector could be impacted and that could affect the ability of consumers to address everyday risks that are covered by the property casualty industry.”

Possible Support for Businesses

The very recent decision of MDS Inc. may support businesses arguing for an expanded definition of “physical damage” to obtain coverage for business interruption losses in the context of the COVID-19 pandemic.

In MDS Inc., the plaintiff’s business relied on radioisotopes purchased from a nuclear facility that unexpectedly shut down as a result of a heavy radioactive water leak. The plaintiff submitted a claim for lost profits under a broad all-risks policy covering property against physical loss, which was denied by the defendant insurer.

Among other things, the Court considered an exception (for resulting “physical damage”) to an exclusion (for corrosion) in order to determine if the loss was covered, in the event that the exclusion applied. The Court interpreted the exception broadly, consistent with the Supreme Court’s guidance in Ledcor, and found that it included loss of use of the nuclear reactor. In short, the Court held that resulting “physical damage” from an excluded peril can include loss of use of a supplier’s premises that is shut down because of actual physical damage (the heavy radioactive water leak). As a result, the Court found coverage for the supply chain disruption.

In seemingly expanding the definition of resulting “physical damage” to include loss of use of the supplier’s business premises, businesses could be looking to rely upon MDS Inc. if premises were closed due to COVID-19 being physically present. It is important to note, however, that MDS Inc. did not involve a pandemic, and it did involve actual physical damage. MDS Inc. was decided on a unique set of facts and may very well be appealed. It remains to be seen how Courts will respond to losses specifically caused by COVID-19.

Summary

If you are an insurer or an insured business and want to know whether your policy covers business interruption losses caused by the COVID-19 pandemic and related civil authority-ordered closures, you should undertake a thorough review of your insurance policy. If you would like our assistance with the interpretation of your policy and scope of coverage, please contact us.

Ryan Phillips is a partner at JSS Barristers. Click here for his bio

Maureen McCartney-Cameron is counsel at JSS Barristers. Click here for his bio.

[1] Veresen Inc v Ace American Insurance Company, 2018 ABQB 893, paras 27-29.

[2] Ledcor Construction Ltd. v Northbridge Indemnity Insurance Co., 2016 SCC 37, paras 49-52.

DISCLAIMER: This publication is not legal advice and should not be relied upon as legal advice. While we intend to provide generalized information that is accurate as at the date of publication, it is possible that the information contains errors or omissions. We disclaim any liability for errors or omissions. Actions taken, or not taken, in response to legal concerns should be guided by individualized legal advice provided within a solicitor client relationship. The creation of a solicitor-client relationship can be discussed upon direct contact with a lawyer.